Problems

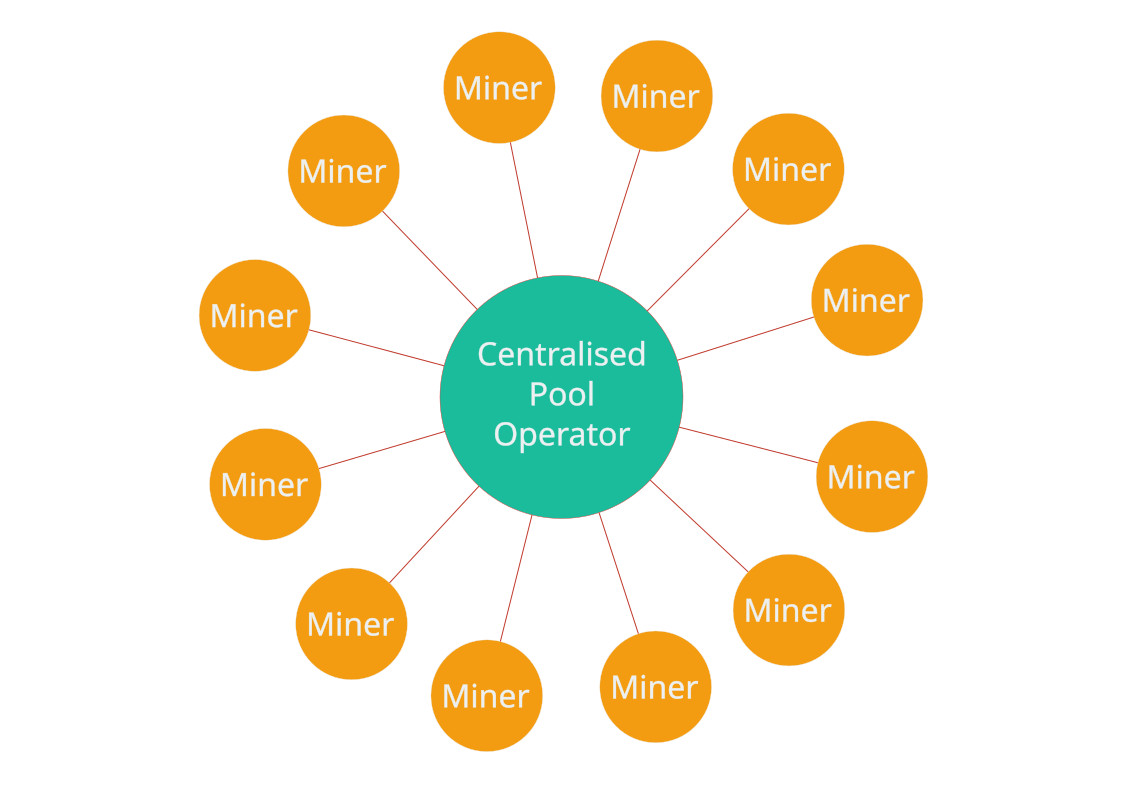

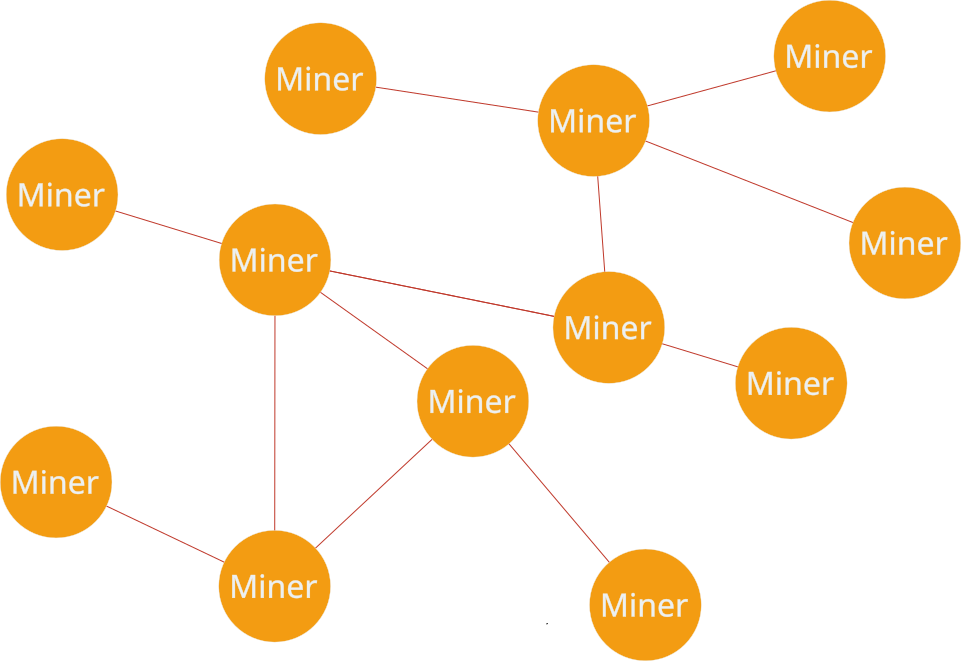

Current efforts to build mining pools can be split into two approaches - centralised pools with a single entity running the pool services or P2P pools. Centralised pools carry out share validation, accounting and reward distribution using a single entity. In contrast, P2P pools push these operational responsibilities to the edges of the network - i.e. the miners.

In this section, we describe the problems faced by both these approaches.

Problems with Centralised Pool

Vulnerable to Attacks

Centralised pools remain vulnerable to attacks that can force them to censor transactions. Given all centralised pools currently run proprietary stacks run in the cloud, it is not easy to spawn new pools when such attacks come in the future.

Centralised Block Template Generation

All pool operators use a single block template that they generate and distribute work to miners based on that block template. Stratum V2 attempts to solve this problem, however, the centralised pool can still censor a miner by refusing to accept the proposed block template or refusing to pay the miner after the fact, as the centralised pool retains the control on their payout mechanism.

Opaque Share and Fee Accounting

The collection of shares is opaque in all centralised pools, so miners can’t verify that they are being paid fairly. Ocean’s approach with TIDES enables verification of each miner’s shares, however, miners still can’t verify the fees charged by the pool is uniform across all miners. It is quiet possible that larger miners get a discounted fees on centralised pools.

Problem With P2P Pools

Added Friction To Migrate

Peer to peer pools require that miners run additional services next to their mining rigs. These services are required to build block templates and to reach consensus on the share and reward distribution. We believe this added friction will reduce the adoption of P2P pools for miners who don’t want to run additional services along with their miners. Given that the long tail of miners can be critical to resisting mining centralisation pressure, our goal is to eliminate any friction in moving to Radpool.

Custodial Payouts

In P2P pools, miner payouts are under the control of a threshold signature, which can be hijacked by someone with a 51% hashrate on the pool. Ideally, we need a solution where a mining doesn’t require permission from the threshold of miners to exit the pool with their payout. Braidpool’s UHPO model is an example where a miner needs permission from a threshold of miners to exit with their payout.

Challenges of Scale

P2Pool used a single block chain to provide consensus on the PoW shares generated by miners. However, the use of linear chain resulted in the limits on how many miners the pool could co-ordinate. As more miners joined the pool, more shares were deemed Dead on Arrival, i.e. they didn’t earn a reward for the work done. This problem can be solved by using a DAG instead of a linear chain, however, reaching consensus on the scale of 10,000 nodes is still an unsolved problem. There are some protocols from academia, but none of those have reached production scale of tens of thousands of nodes. Kaspa uses a DAG based PoW backed consensus algorithm, but Kaspa’s network is still less than 500 nodes. If we need to scale to tens of thousands of miners, we don’t yet have a proven consensus protocol that can scale to such a large network.

Threshold Signature In P2P Network Model

Running Threshold Signatures on a P2P model also has challenges. The network model required by FROST needs nodes to be connected in a point to point network, and running gossip broadcast breaks the assumptions made in the security proofs of threshold signature protocols.

The next pages present a new design that uses a syndicate of operators to replace centralised pool operators, and avoids the above listed problems. First we describe our solution and then address how we avoid all of the above problems.